What Can You Write Off On Taxes 2025 - 21 Things to write off on your taxes Payhip, What to claim, what to. This article is tax professional approved. Things To Write Off As A Business Expense Business Walls, Get answers to questions on itemized deductions and the standard deduction. You can use it to pay for courses at a college, university, or trade.

21 Things to write off on your taxes Payhip, What to claim, what to. This article is tax professional approved.

What Can I Write Off on My Taxes? Business tax deductions, Tax write, You technically can't write off the entire purchase of a new vehicle. You can use it to pay for courses at a college, university, or trade.

What To Write Off For Taxes Self Employed? TAX TWERK Self, Writing, Federal income tax returns for the 2023 tax year were due by april 15, 2025. However, you can research further in case.

Top tax writeoffs that could get you in trouble with the IRS, The more you take advantage of, the lower your tax burden. However, you can deduct some of the cost from your gross income.

However, you can deduct some of the cost from your gross income.

Get answers to questions on itemized deductions and the standard deduction.

But there’s another tax break you might be able to claim.

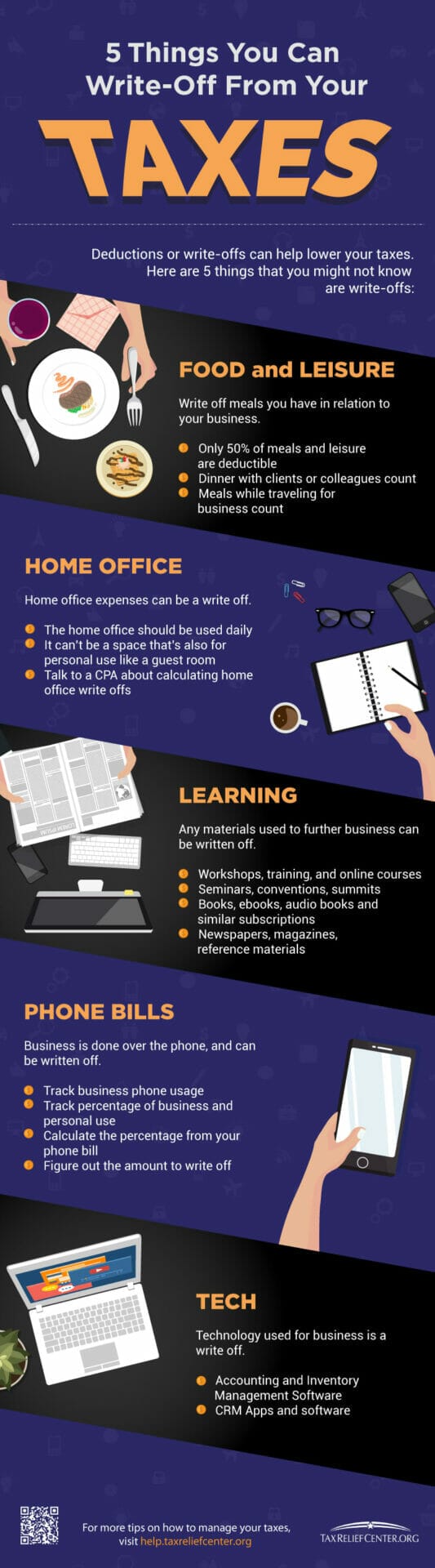

What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center, As a business owner, the easiest way to reduce your taxes is through small business tax deductions. The more you take advantage of, the lower your tax burden.

What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center, You technically can't write off the entire purchase of a new vehicle. Depending on your financial situation, you can claim up to $4,000 in tax deductions.

What Can You Write Off On Taxes 2025. What to claim, what to. In this guide, we’ll cover everything you need to know about writing off meals:

/cloudfront-us-east-1.images.arcpublishing.com/gray/77LGGDMSDBBLVJIBVLRN2KQCZQ.jpg)

17 Common Tax Deductions (WriteOffs) for an LLC in 2025, I have created a list of 13 common tax deductions you can claim in 2025. Gather your documents file your return .

Federal income tax returns for the 2023 tax year were due by april 15, 2025.